Alternative FX Data – FX data comes of age

Johnstone joined CLS in September 2019 and her ambitious plans include leveraging CLS’s unparalleled coverage of currency market volume data, which can be used for developing investment strategies, monitoring best execution/transaction cost, enhancing risk management, and fine-tuning algorithmic trading.

“CLS shares a similar profile to a stock exchange for various aspects of its operations, including rigorous data governance and risk management,” says Johnstone, whose previous role was Head of Buy Side Sales at Euronext.

“A key difference is that CLS is not a trading venue, therefore, we don’t provide tick-by-tick trading data. Our data is derived from settlement data, which means that the design of datasets needs to be different. Our goal is to provide market participants with greater transparency of the FX market combined with comprehensive data analytics.”

“We are not just forecasting based on history. We use more holistic approaches to identify pre-trade signals and how they correlate with CLS trading data.”

The FX market presents special data challenges. It is distinguished from other financial markets by its huge size – $6.6trn per day in April 2019 according to the latest triennial BIS Survey. Currencies still have far more over-the-counter (OTC) trading than other assets, with 30% of FX trades resulting from voice tradin…

The FX market presents special data challenges. It is distinguished from other financial markets by its huge size – $6.6trn per day in April 2019 according to the latest triennial BIS Survey. Currencies still have far more over-the-counter (OTC) trading than other assets, with 30% of FX trades resulting from voice trading, and the majority of FX volume is between dealers. “We understand only about 20% of FX trading is via electronic algorithms, versus 80% in the equity markets, but equity markets had very little electronic trading 15 years ago,” Johnstone says. “We expect that greater transparency will lead to more automated trading in FX.”

And so, the CLS offering is buzzing with initiatives as a strong pipeline of research and analytics is being developed in collaboration with clients. In parallel, CLS continues its support of industry best practice initiatives, such as the FX Global Code − an initiative to promote the highest ethical standards and best practices for the FX market among all market participants.

Alternative FX data

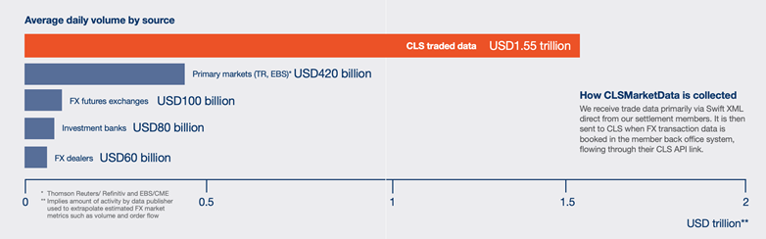

CLS plays a vital role in illuminating the currency markets because its settlement system captures over $1.55trn a day, amounting to more than 50% of FX market volume for CLS-settled currencies. In comparison, primary markets (Thomson Reuters/Refinitiv and EBS/CME) volume is $420bn, futures is $100bn, investment banks is $80bn and FX dealers is $60bn, according to CLS (Fig.1). CLS data is provided daily, whereas regional central bank data tends to be reported every six months, and the BIS survey is only triennial. CLS data is derived from the banks that submit payment instructions for settlement immediately after execution, from circa 25,000 participants and 500,000 trades per day. The CLS FX Spot Volume report currently provides executed intraday FX trades for 18 currencies and 33 currency pairs – both figures that are expected to grow.

Other subjects within the full article include:

- Investment strategies

- Pre-trade analysis

- Post-trade analytics

- Data enhancements

- Analytics