CLSMarketData insights around COVID-19

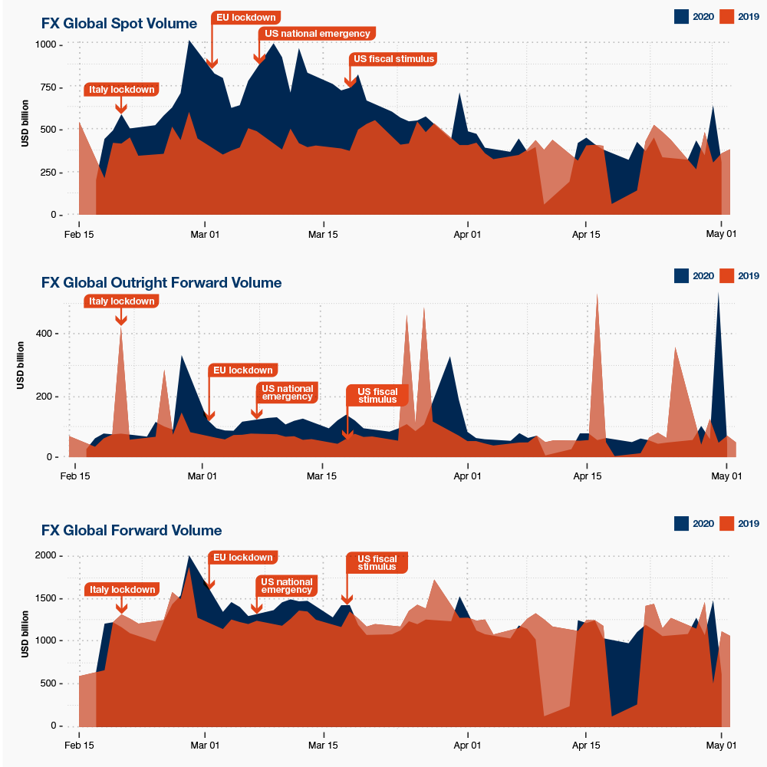

We witnessed a significant volume surge across all FX instruments and currencies, coinciding with the COVID-19 related events between the Italian lockdown and the US stimulus announcements. Specifically, we saw the largest YoY spike in the average daily FX Spot volume, up 66% comparing to the same period in 2019. During the month of April we began witnessing spot volume retraction to pre-pandemic levels as global economies prepare to reopen

1.

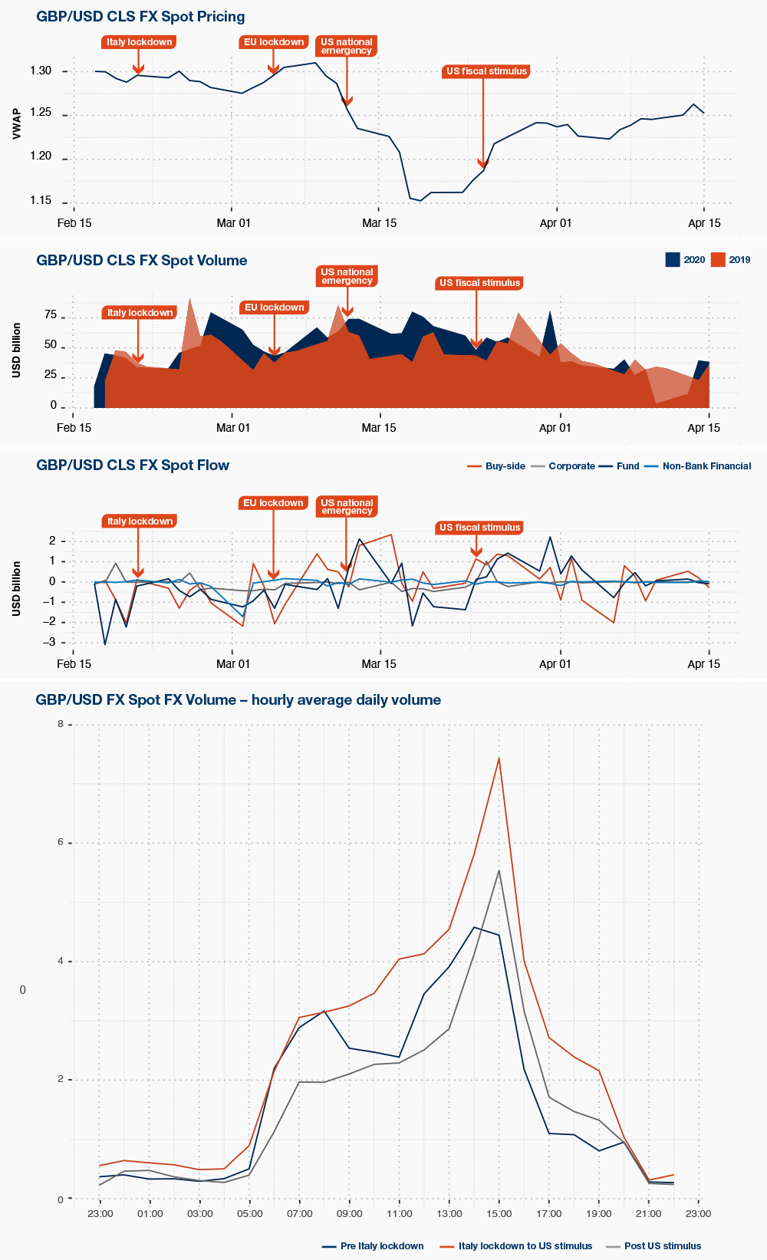

GBP/USD

In the last month, we saw a contraction in average hourly volume during the London morning trading hours, compared to the start of the year. Volumes remain lower than those traded after the Italian lockdown when we witnessed sharp sell-off activity in GBP/USD by all market participants, which resulted in a CLS all-time low of USD1.14177 on 20 March.

2.

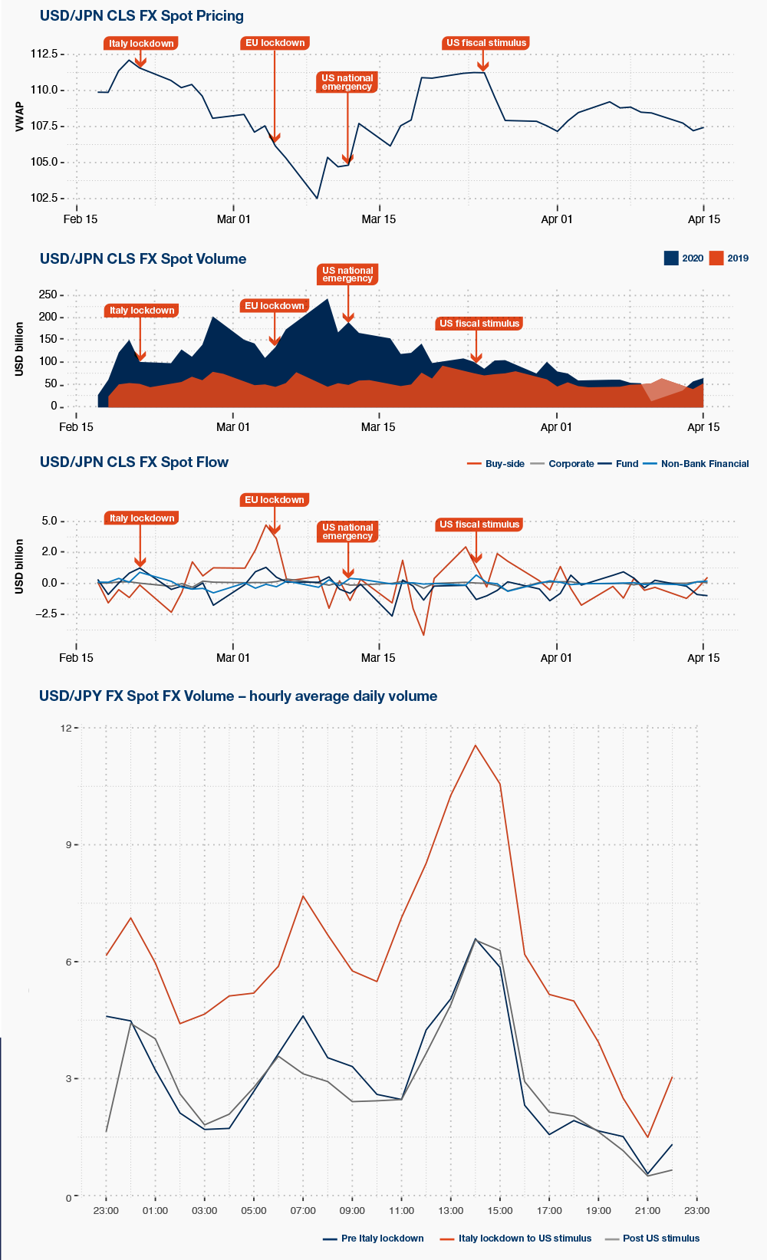

USD/JPY

Trading activity has been predominantly driven by buy-side participants, with significant buying activity at the start of March followed by a major sell-off after the US declared a national emergency. In the same period, our data shows that since the start of the European lockdown on 05 March USD/JPY, spot volume increased significantly by USD201 billion compared to the same period in 2019.

3.

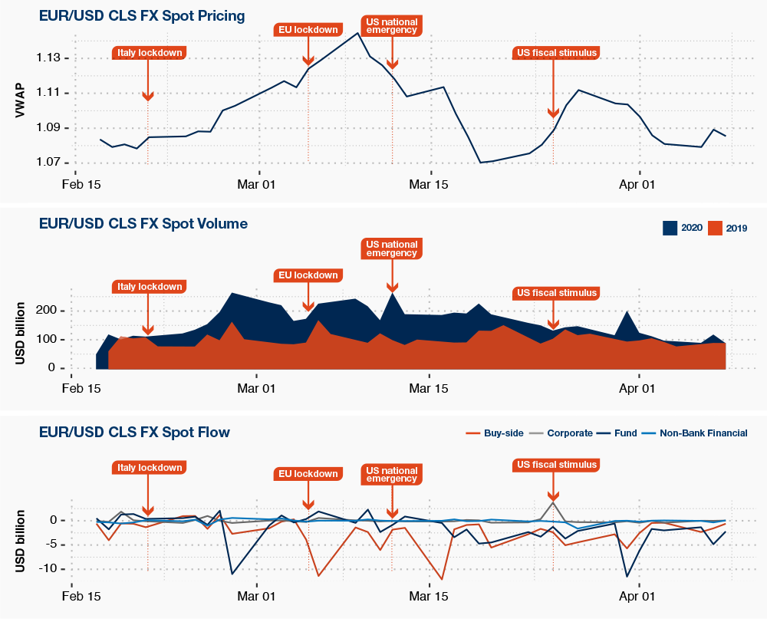

EUR/USD

We witnessed an increase of USD166 billion in EUR/USD traded volumes in the first quarter of the year which can be traced back to Italy’s lockdown to contain COVID-19 (in March 2020). During this period, trading activity associated with the sell-off of euros was dominated by the buyside and funds. View the full charts & flow drivers below: