The value of trading volume in FX and the use of machine learning

Article

15 Min Read

Article

15 Min Read

With FX price volatility and market liquidity becoming increasingly difficult to predict, learn how high quality, executed trade data and statistical algorithms allow for more accurate volume forecast models.

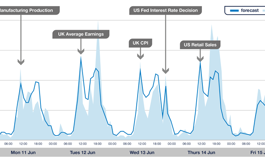

See below a comparison of CLS predicated volumes against the actual GBP/USD volumes during major economic events.

Learn how CLS are helping FX participants to forecast FX volumes and navigate the changing market environment by downloading our whitepaper.

Integrating executed FX trade data into the buy and sell-side communities.

Download whitepaper