CLSSettlement

With CLSSettlement, you can mitigate settlement risk for your FX trades while benefiting from operational efficiencies, in addition to best-in-class netting and liquidity management.

The global standard in FX settlement risk mitigation

Each day we settle over USD7.0 trillion of payments in 18 of the most actively traded currencies globally, protecting our members and their clients from the most significant risk in the FX market – settlement risk. We do this by simultaneously settling payments relating to FX trades using our unique payment-versus-payment system (PvP).

Delivering huge efficiencies in FX trade settlement and savings for our clients

Our centralized platform and approach to multilateral netting mitigates settlement risk, reduces costs – and shrinks funding requirements by over 96% – so you can put your capital and resources to better use.

That’s why over 70 of the world’s most important financial institutions choose to be members of CLSSettlement – and over 37,000 more use our FX risk management services, including banks, funds, non-bank financial institutions and multinational corporations. CLSSettlement – offers the global standard in FX settlement risk mitigation.

CLSSettlement improves

- Operational and funding efficiencies

- Access to liquidity

CLSSettlement reduces

- Settlement risk

- Credit risk

- Operational risk

- Liquidity risk

FX Global Code

Supporting adherence to the FX Global Code through:

- Principle 35, settlement risk

We deliver huge efficiencies and savings for our clients so you can put your capital and resources to better use.

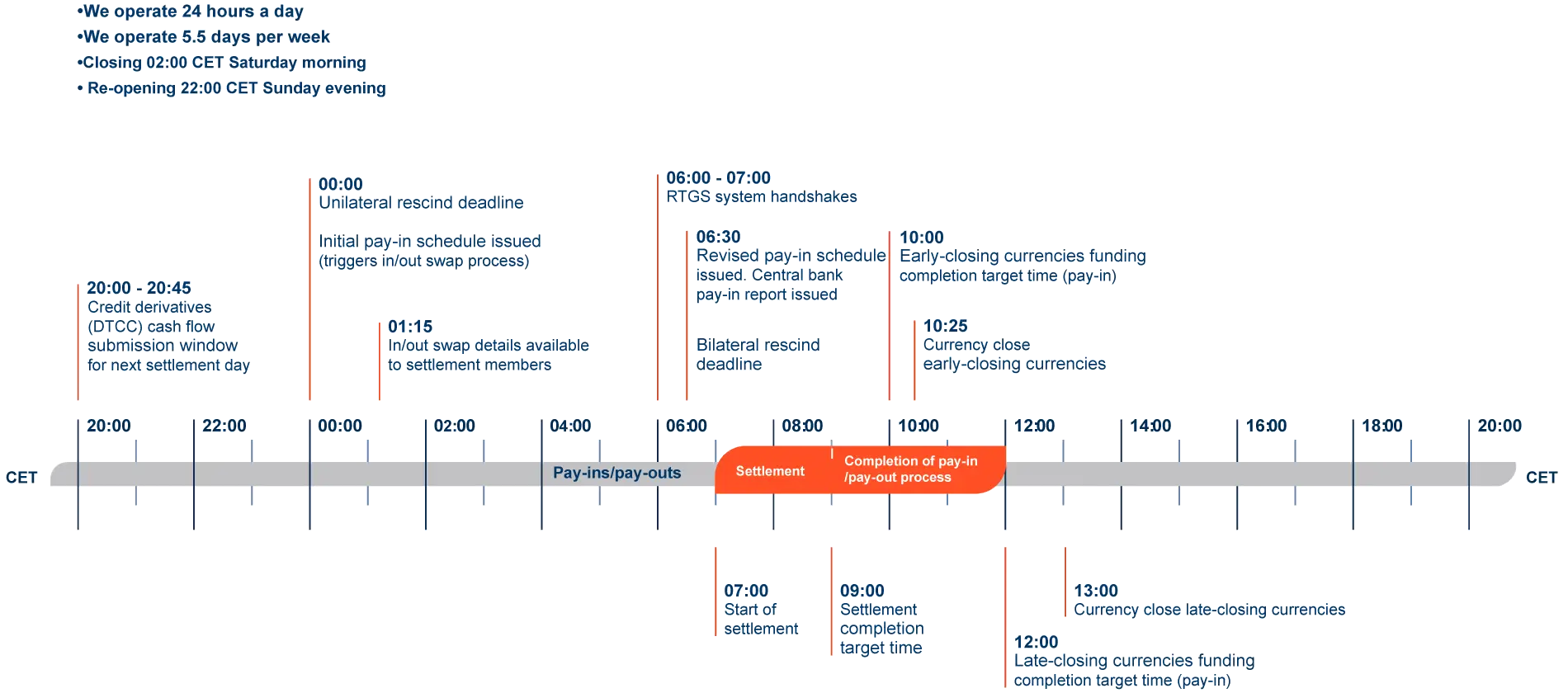

Operational timeline

Contact us to find out more

Latest news

CLS FX trading activity | May 2025

CLS FX trading activity | April 2025

CLS FX trading activity | March 2025

The T+1 journey is far from over

Rethinking FX Settlement Cycles

CLS FX trading activity | February 2025

CLS FX trading activity | January 2025

Shaping FX: Leaders in FX – event recap

CLS FX trading activity | December 2024

CLS welcomes NYK Line to CLSSettlement

CLS FX trading activity | November 2024

Building buy-side momentum in an evolving FX ecosystem

Société Générale goes live on CLS’s cross currency swaps service

CLS FX trading activity | October 2024

Looking ahead: The evolution of FX risk mitigation

CLS FX trading activity | September 2024

CLS wins “Best FX Clearing and Settlement Provider” at Euromoney’s FX Awards 2024

CLS FX trading activity | August 2024

The importance of PvP in an everchanging FX ecosystem

CLS FX trading activity | July 2024

CLS speaks to e-Forex about the issues facing FX market participants

CLS FX trading activity | June 2024

Update on the impact to CLSSettlement following the move to T+1 for securities settlement in the US

CLS FX trading activity | May 2024

Navigating the T+1 Transition: the FX impact on the asset management community

Barclays Bank goes live on CLS’s Cross Currency Swaps service

CLS FX trading activity | April 2024

The move to T+1 in the North American securities markets

Navigating the T+1 implications for FX traders

CLS FX trading activity | March 2024

CLS FX trading activity | February 2024

T+1 US Settlement: Implications for APAC

Tackling FX settlement risk: the power of public-private partnerships

CLS FX trading activity | January 2024

The ripple effect of US T+1 settlement

The growth of CLSNet, the next best thing after CLSSettlement

CLS welcomes additional Japanese manufacturing company to CLSSettlement

CLS FX trading activity | December 2023

BNY Mellon and ING agree to join CLSNet community

CLS FX trading activity | November 2023

The continued rise of CLSNet: A new chapter in FX market efficiency

CLS welcomes first Taiwanese bank to CLSNet

CLS welcomes Tokio Marine Holdings group companies to CLSSettlement

CLS FX trading activity | October 23

CLS FX trading activity | September

CLS wins “Best FX Clearing and Settlement Provider” at Euromoney’s FX Awards 2023

CLS FX trading activity | August

CLS adds three clients to its cross currency swaps service

The optimal model for mitigating FX settlement risk

CLS FX trading activity | July

A Look Ahead. Marc Bayle de Jessé speaks to E-forex

Deutsche Bank joins CLS’s bilateral netting calculation service, CLSNet

CLS FX trading activity | June 23

CLS FX trading activity | May 23

CLS appoints six new board directors

CLS wins “Best Settlement Initiative” for CLSSettlement at FX Markets e-FX Awards 2023

CLS welcomes first Thai third-party bank to CLSSettlement

CLS FX trading activity | April 23

CLS FX trading activity | March 23

CLS FX trading activity | February 23