Bank of Japan intervention | CLSMarketData insights

CLSMarketData can be used to understand how the FX market reacts during significant market events. Our position at the center of the FX ecosystem enables us to capture a uniquely large and diverse amount of data across market makers and price takers to deliver data-driven insight into market dynamics.

Market participants can use our data to enhance trading strategies to reflect market trends and respond quickly to changes in market conditions.

BOJ conduct three currency interventions in 2022

The role of the Bank of Japan (BOJ), Japan's central bank, is to ensure financial stability and promote economic growth in Japan using monetary policy tools. In 2022, the BOJ used foreign exchange (FX) interventions to stabilize FX rates by containing excessive rate fluctuations. The data analysis below, derived from our alternative FX datasets, highlights the impact of three interventions on the stability of the Japanese yen (JPY) during that year. The first intervention was on 22 September (JPY2.8 trillion), followed by two more on 21 October (JPY5.6 trillion) and 24 October (JPY7.2 trillion).

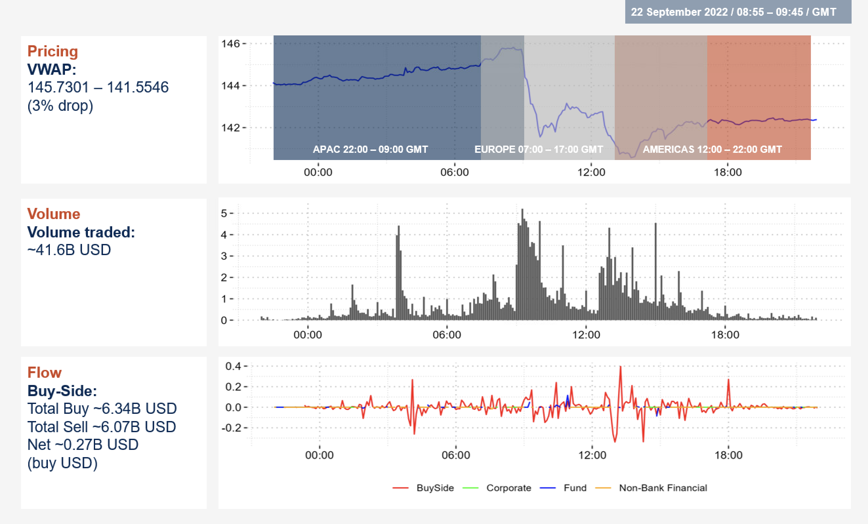

First intervention

22 September 2022

Between 08:55 – 09:45 GMT

The BOJ intervened in the FX market by selling USD against JPY. As a result, the JPY appreciated by 3% from 145.7301 to 141.5546 between 08:55 and 09:45 GMT. During the same period, CLS witnessed a spike in FX spot volumes, which traded to USD41.6 billion.

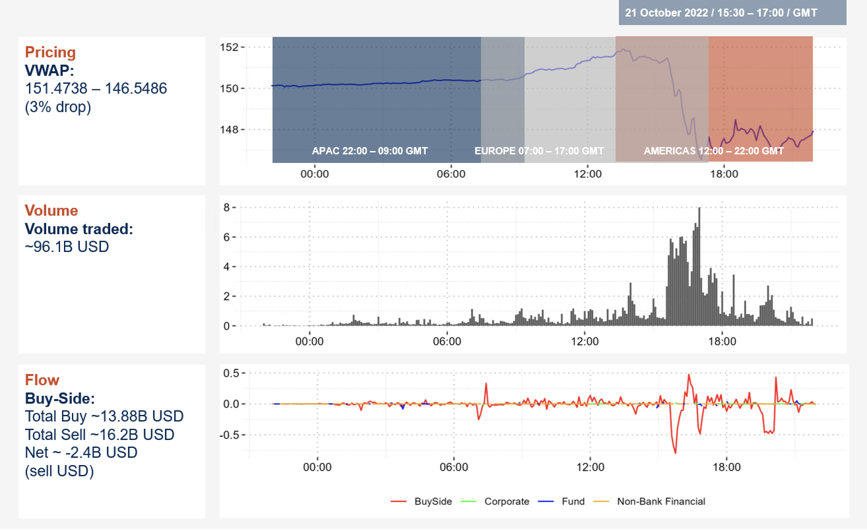

Second intervention

24 October 2022

Between 15:30 – 17:00 GMT

On 21 October, the BOJ intervened again by selling USD against JPY. As a result, JPY appreciated by 3%, this time from 151.4738 to 146.5486 between 15:30 and 17:00 GMT. Over the same period, there was a spike in daily FX spot volume, which traded to USD96.1 billion with a buy-side trade imbalance in FX spot flow of USD2.4 billion against JPY. This negative buy-side trade imbalance indicated a bearish view on USD.

Buy-side trade imbalances, illustrated in our FX spot flow data, can be used to measure market sentiment. A positive imbalance indicates a bullish USD view, and a negative imbalance indicates a bearish view.

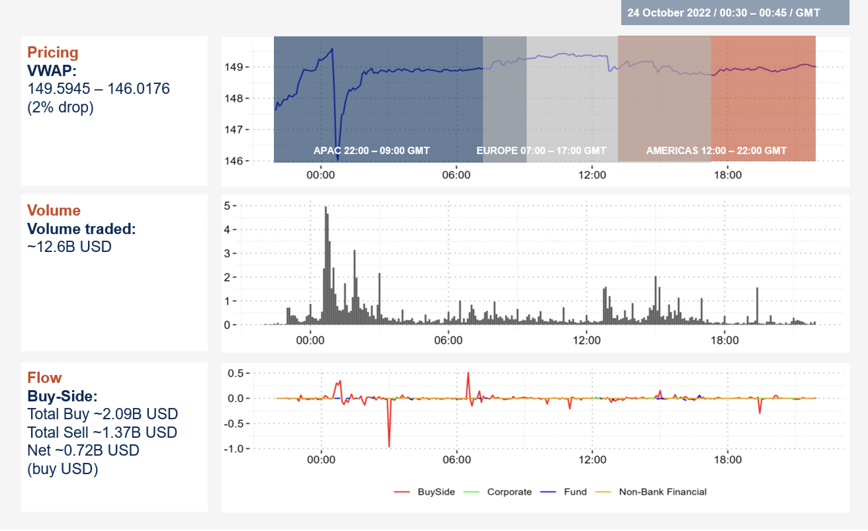

Third intervention

24 October 2022

Between 00:30 – 00:45 GMT

On 24 October, the BOJ intervened for the third time, again by selling USD against JPY. As a result, JPY appreciated by 2%, from 149.5945 to 146.0176 between 00:30 and 00:45 GMT. During the same period, there was a spike in daily FX spot volumes, which traded to USD12.6 billion with a buy-side trade imbalance in FX spot flow of USD720 million against JPY.

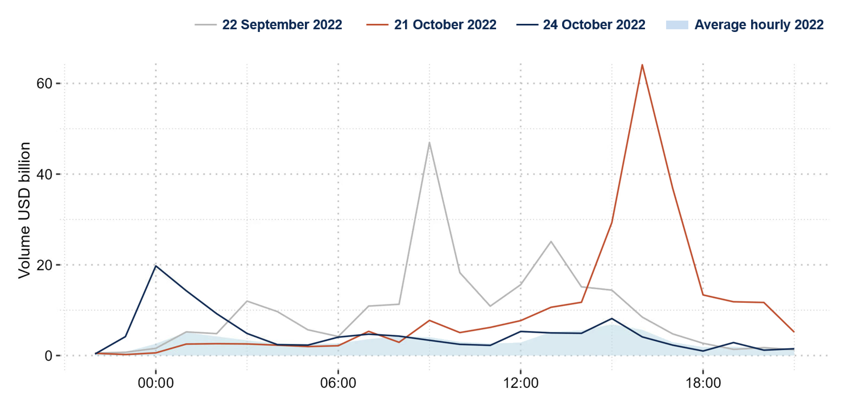

Appreciation in the value of JPY

The BOJ’s interventions stabilized the value of JPY, topping off at JPY 151.94 in October 2022. The interventions led to an appreciation in the value of JPY at least temporarily in all three cases, with the largest of 3% occurring on 22 September and 21 October. FX spot volumes spiked in all three instances.

Market participants can leverage the power of this information to understand market dynamics and help improve decision making.

Three interventions

Average USD/JPY volume profile 2022

The chart below displays the average volume profile of USDJPY for 2022, represented in the blue shading, along with the three interventions by the BOJ. This chart illustrates how these events influenced trading activity and liquidity providing enhanced intraday visibility of market activity.

Use CLSMarketData to analyze changes in market sentiment.