FX Ecosystem 07 | CLS and FX: A pioneering partnership with pivotal purpose | ShapingFX series

As the trusted guardian of the foreign exchange (FX) market, CLS currently settles approximately USD7 trillion daily, across 18 of the world’s most traded currencies. The journey to get here has been one of public private sector collaboration and evolution in an ever changing FX ecosystem. This paper elucidates the pivotal purpose of CLS, considers the historical context that drove its creation and subsequent growth, and finally ponders what could be next for the FX market.1

Crises and committees

The story of CLS began long before its 2002 go-live. In fact, its creation is deeply rooted in 1974, the year following the fall of the Bretton Woods system.2 Attention sharply focused on settlement risk in FX transactions when Bankhaus Herstatt collapsed, the “first and most dramatic case of a bank failure where incomplete settlement of FX transactions caused severe problems in payment and settlement systems.”3 Although Herstatt was a medium sized German bank, it was a substantial player in the FX market, and its collapse was an “epochal event that sent shockwaves” through the FX market.4

Herstatt’s closure caused a chain reaction as other banks refused to make their payments and closed their credit lines for banks that were suspected Herstatt counterparties. As it was unknown which banks had suffered losses, most banks were unwilling to meet their obligations unless they received confirmation that the counter-payment had been received. The USD/DEM (Deutsche mark) market collapsed. The New York interbank market nearly collapsed, and the recovery took several days.5

Herstatt’s downfall created tremendous distrust among banks and widespread panic in the market. This marked the first time that settlement risk in FX trading had attracted major public attention, highlighting the threat of FX settlement risk to the global financial sector. Settlement risk is the risk that one party to an FX transaction delivers the currency it sold but does not receive the currency it bought, resulting in a loss of principal. To this day, settlement risk is often referred to as “Herstatt Risk”.6

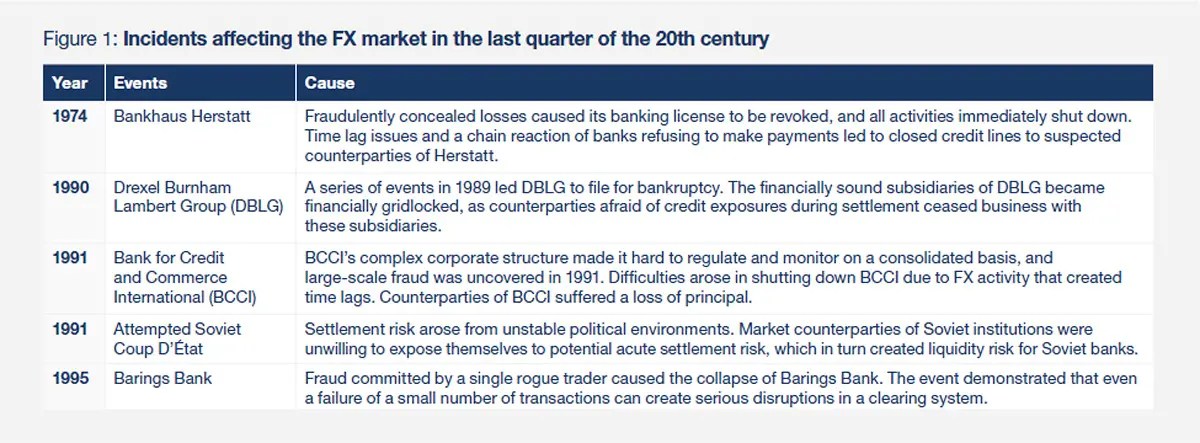

Following the Herstatt collapse, a series of “real losses and near misses”7 occurred over the last quarter of 20th century, which time and time again highlighted the significance of settlement risk and its systemic implications in a growing FX ecosystem (figure 1). These incidents prompted two main threads of work by the global public policy community.

First, central banks focused on international cooperation to reduce risks in the FX market.8 Second, global standards were established with the aim of ensuring that the infrastructure supporting global financial markets is robust and able to withstand financial shocks.9

In relation to the first thread of work, the Group of 10 (G10) central banks formed committees such as the Group of Experts on Payment Systems and the Committee on Interbank Netting Schemes to monitor these issues and provide future guidance and recommendations. The reports published by these forums provided guidance regarding developments of new settlement standards. In 1990, these committees were replaced by the Committee on Payment and Settlement Systems (CPSS), which continued and extended their work.10 The CPSS was renamed, with a new mandate and charter, to the Committee on Payments and Market Infrastructures (CPMI) at the June 2014 central bank Governors of the Global Economy meeting.

Through the 1990s, a series of reports published by the CPSS (figure 2), entwined with various incidents that exposed the dangers of settlement risk (figure 3) led to a global effort to develop new settlement standards for FX transactions, and ultimately to the development of the CLS settlement system.

1 This paper utilizes Dr. Alexandra Scriba’s thesis published in 2007, entitled “Continuous Linked Settlement: History and Implications”.2 See: cls_fx_policy_02_fall_of_bretton_woods_fx_50years_afloat_shapingfx_series_oct2023.pdf

3 See: Settlement risk in foreign exchange markets and CLS Bank - BIS Quarterly Review, part 6, December 2002. 4 “Herstatt risk” still has relevance half a century on from bank’s demise - Banking Risk and Regulation, 2024.

5 Dr. Alexandra Scriba, “Continuous Linked Settlement: History and Implications”, 2007, p.33.

6 See Sawaichiro Kamata, 1990. “Measuring “Herstatt Risk”,” Monetary and Economic Studies, Institute for Monetary and Economic Studies, Bank of Japan, vol. 8(2), pages 59–74, September.

7 Dr. Alexandra Scriba, “Continuous Linked Settlement: History and Implications”, 2007, p.32.

8 Dr. Alexandra Scriba, “Continuous Linked Settlement: History and Implications”, 2007, p.33.

9 International standards such as the “Core Principles for systemically important payment systems” were eventually established by the BIS Committee on Payment and Settlement Systems (CPSS) in 2001 and replaced by the “Principles for financial market infrastructures” (PFMI) in 2012. 10 For more information on the history of the CPMI, see: History of the CPMI.