CLSNow

Mitigate the settlement risk associated with the out-legs of CLSSettlement in/out swaps and other same-day FX transactions through CLSNow – our gross payment-versus-payment (PvP) settlement service.

Our leading PvP settlement service, CLSSettlement, protects a substantial part of the global FX market from the most significant risk – settlement risk. However certain segments of the market, such as same-day FX and the out-legs of CLSSettlement in/ out swaps,remain unprotected.1 This can leave market participants with considerable FX settlement risk exposure. CLSNow addresses this challenge.

With access to trade-by-trade matching and PvP gross settlement on a bilateral same-day basis, you can mitigate the loss of principal and other elements of settlement risk in the same-day market, including the out-legs of in/out swaps.

How it works

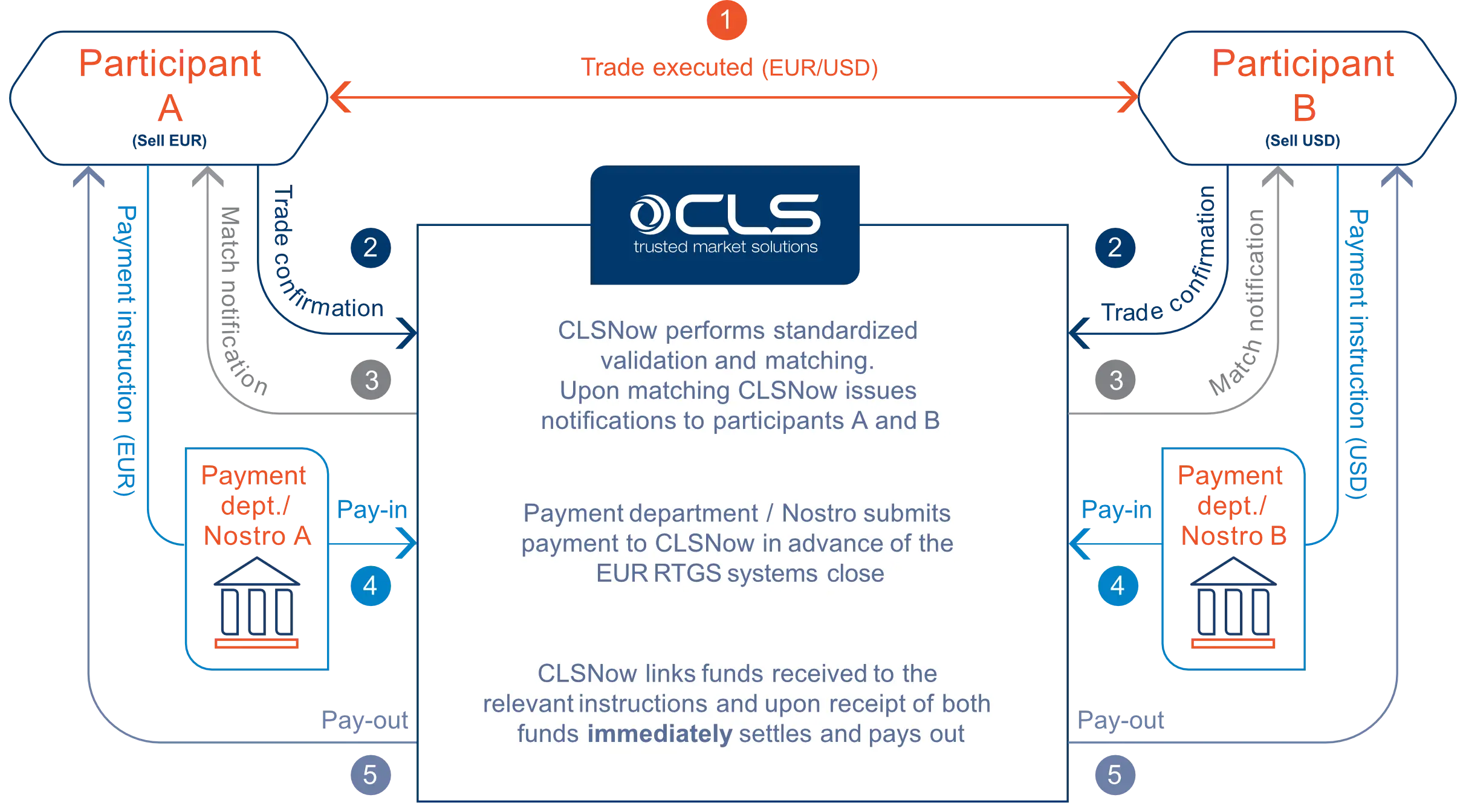

Transaction validation and matching:

Upon matching both sides of a qualifying FX trade, we send a match notification to participants.

Payments processing:

Participants submit payments to CLSNow based on trade instruction details. We will match the payment to the relevant instruction and identify both sides of the trade as fully funded.

Settlement:

Once payments have been identified as fully funded, we send a settlement notification to participants. Settlement occurs immediately upon payment receipt from both parties to the trade. The settlement of these payments is final and irrevocable.

Pay-out:

We will then pay out the funds to the respective participants.

1 In/out swaps is a CLSSettlement mechanism through which settlement members are able to reduce the liquidity needed to fund settlement by allowing some of the funding to be spread to other times during the day; however, this reallocation reintroduces settlement risk to the market.

Improves

- Operational and funding efficiencies

- Access to liquidity

700+ USD billion

Daily gross value (USD equivalent) that is settled on average in the sameday FX market outside of CLSSettlement, across CAD, CHF,2 EUR, GBP and USD, including the out-legs of in/out swaps

Reduces

- Settlement risk

- Credit risk

- Operational risk

- Liquidity risk

2 Subject to all necessary approvals

Awards

- Best Settlement Initiative 2023, FX Markets e-FX 2023

- Best FX Settlement & Risk Mitigation Solution, FX Markets Asia 2022 / 2021 / 2020

- Best Trading Infrastructure Provider, American Financial Technology 2021

Benefits:

- PvP settlement of the out-legs of in/out swaps and other same-day FX transactions

- Reduce counterparty credit risk through the timely exchange of cross currency flows

- Preserve in/out swap credit limits and potentially reduce cash buffer requirements

- Strengthen recovery and resolution planning

- Raise counter currency during market stress events with access to trade-bytrade matching and PvP settlement on a bilateral basis

Single trade settlement flow

Risk mitigation:

- Reduces risk of loss of principal and other elements of settlement risk

- Settlement finality

Operational efficiency:

- Efficient settlement with agreed market practices

- Elimination of post trade reconciliation items

Treasury and liquidity risk management:

- Balance sheet and P&L usage – strengthen recovery and resolution planning around market stress events

What is settlement risk?

To settle an FX transaction, counterparties need to exchange principal (value of the trade) in two currencies. Settlement is the risk that one party to an FX transaction delivers the currency it sold but does not receive the currency it bought from its counterparty. The result is a loss of principal. CLS mitigates this by simultaneously settling the payments on both sides of an FX trade.

FX Global code

Using CLS products and services plays an integral part in helping you comply with the FX Global Code.