Cross currency swaps

Mitigate FX settlement risk, improve operational efficiencies and reduce your liquidity and payment demand for cross currency swap trades using our world-leading settlement service.

Cross currency swap trades have significant settlement risk exposure from the high value of the initial and final principal exchanges. In addition, settling these trades on a gross bilateral basis results in operational inefficiencies and liquidity constraints. Our payment-versus-payment (PvP) settlement service helps you mitigate settlement risk, while delivering operational and liquidity efficiencies for cross currency swap trades.

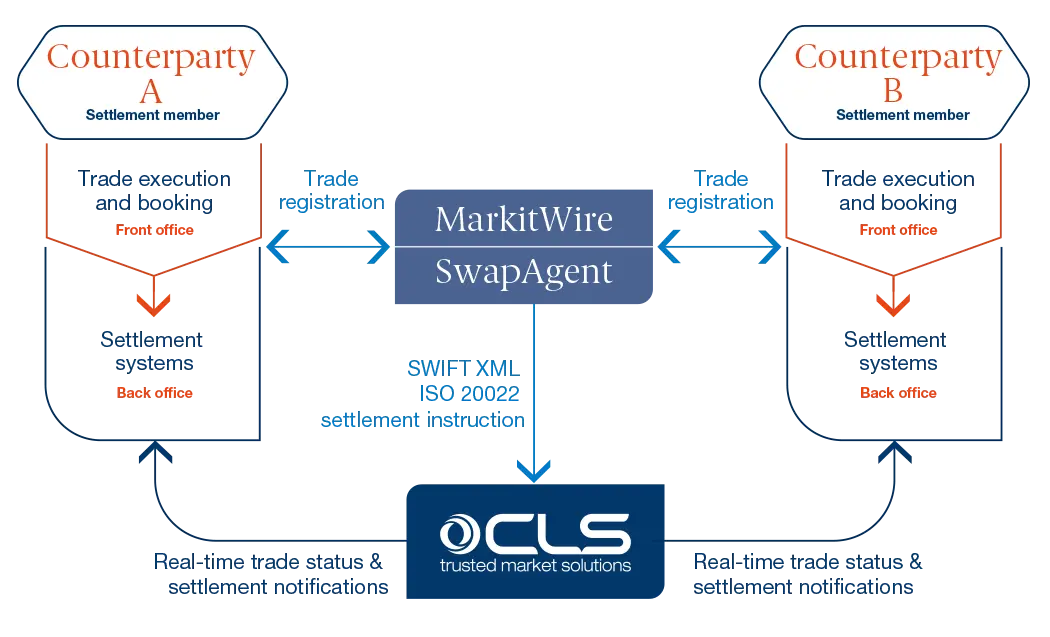

CLS settlement members can use our unique PvP settlement system and netting capabilities in conjunction with post-trade processing platforms – MarkitWire and SwapAgent – to mitigate settlement risk for cross currency swap trades.

CLS settlement members benefit from a standardized process for the payments related to cross currency swap trades by incorporating them into CLSSettlement. We receive transaction data in the form of the notional exchanges associated with cross currency swaps processed using MarkitWire and SwapAgent. CLS settlement members can opt to use one or both platforms as submission channels to CLSSettlement.

Improves

- Operational efficiency

Reduces

- Liquidity and payment demand

- Settlement risk

- Funding costs for bilateral payments

Availability

Available for all cross currency products

Reduces risk

Further reduces systemic risk in the over-thecounter derivatives markets

Awards

- Best Settlement Initiative 2023, FX Markets e-FX 2023

- Best Settlement Initiative 2023, Best FX Settlement & Risk Mitigation Solution FX Markets Asia 2022 / 2021 / 2020

- Best Trading Infrastructure Provider American Financial Technology 2021

Benefits:

- Settlement risk mitigation through PvP settlement

- Operational efficiency through automation and standardization

- Mutual system processing and operational efficiencies

- Reduced liquidity and payment demand – opening up opportunities for increased trading

- Seamless connectivity provided by post-trade processing platforms, MarkitWire and SwapAgent

How it works

CLS settlement members can complete validation and eligibility checks in line with CLS-defined static data and settlement eligibility criteria, through both platforms. Depending on the counterparties’ choice of submission channel and where the eligibility checks have been passed, the channel then sends validated pairs of instructions (one for each counterparty of the cross currency swap) to CLSSettlement (using SWIFT network – ISO 20022 financial XML message standards).

We then communicate any business updates relating to these instructions back to the settlement member’s CLS control branch using existing communication channels.

We also communicate any business updates relating to these instructions (via a periodic trade status update) to MarkitWire and SwapAgent. Both platforms process the information captured in the trade status update report so that our settlement members can see the CLSSettlement status relating to these instructions via the MarkitWire and SwapAgent GUI and API, where relevant.

The cross currency swap-related instructions are included in pay-in schedules along with standard FX instructions. Settlement and pay-outs follow existing funding and payment processes.

How CLSSettlement works for cross currency swaps

Example of potential funding benefits

The example in the table on the right shows indicative figures of potential funding benefits when using CLS, compared with bilateral gross funding and settlement for a typical cross currency swap trade.

Costs for your business may vary and should be calculated using your own data inputs.

Note: Funding cost calculation assumes one day’s cost of funding the pay-out leg and no benefit on the receiving leg.

| Potential cost saving versus bilateral gross funding | Cost of funding |

| Average national value of trade1 | USD144,000,000 |

| Average funding cost (basis points) | 30BPS |

| Trades per day | 2 |

| Business days | 250 |

| Error rates on gross settlement Time to correct errors (2 days) |

3% |

| Funding costs (2 days) | USD36,000 |

| Total annual bilateral settlement costs | USD627,781 |

| Cost of settlement * |

|

| Annual fee | USD62,500 |

| Value/volume charges | USD24,625 |

| Funding costs | USD5,918 |

| Total annual costs for settling through CLS | USD93,043 |

| Total annual cost savings through CLS | USD534,738 |

* Annual fee, value and volume fees charged in GBP. GBP/USD FX rate of 1.25 used.

FX Global code

Using CLS products and services plays an integral part in helping you comply with the FX Global Code.