OTC Derivatives

Asset managers

Harness the joint infrastructure power of CLS and DTCC to better manage your OTC credit derivatives cash flows. Improve overall post-trade efficiency and risk management.

Regulatory reform has led to a changing FX settlement landscape with a heightened focus on pre- and post-trade transparency and an increased requirement for transactional reporting.

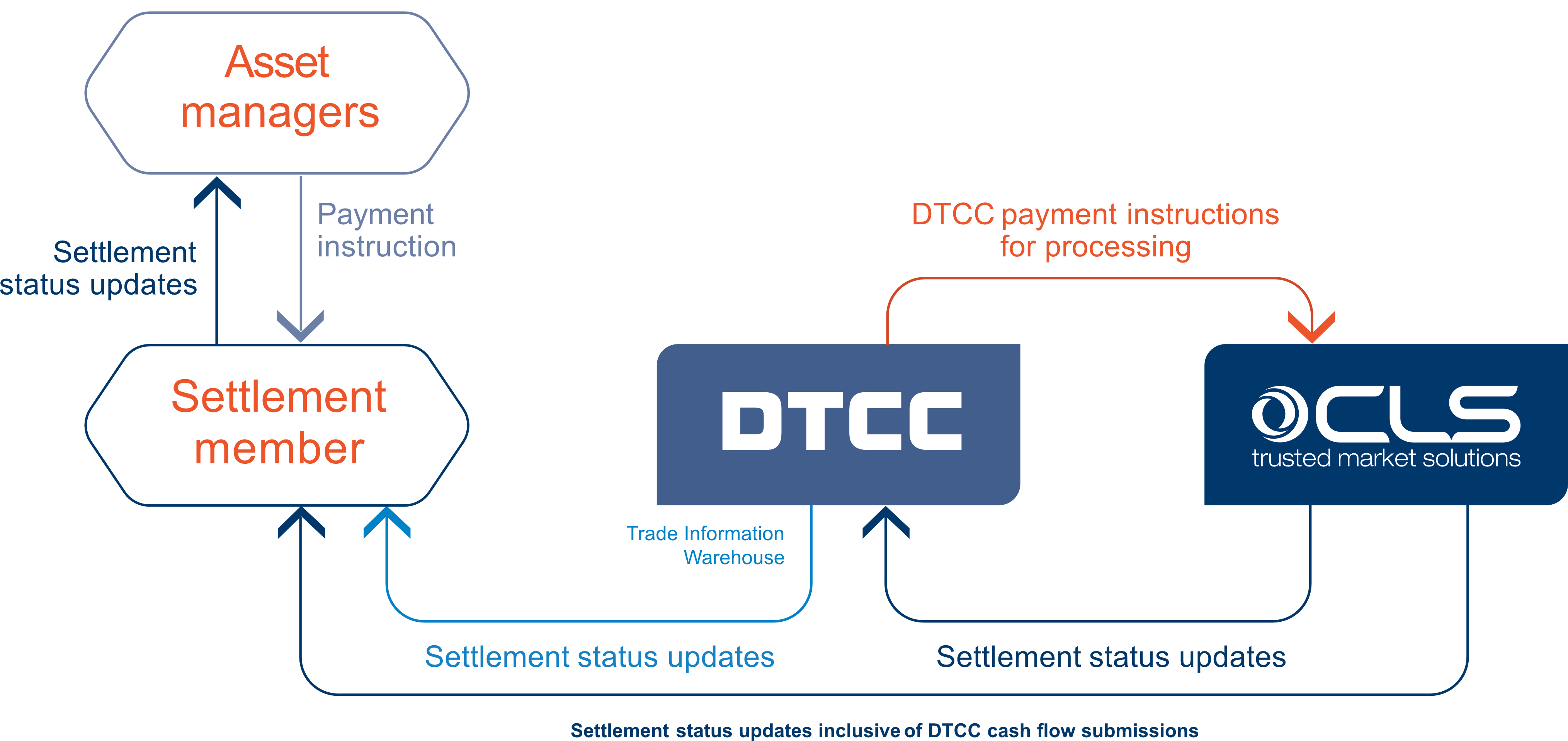

CLS’s OTC Derivatives is an enhanced settlement service model for instructions relating to bilateral net payment obligations for the OTC credit derivatives market. Created in partnership with The Depository Trust & Clearing Corporation (DTCC), the service links DTCC’s Trade Information Warehouse with CLS’s central multicurrency cash settlement service and automates the processing of OTC credit derivatives-related cash flows.

How it works

Asset managers access the service via their custodians – a CLS Settlement member. The service supports nine currencies: AUD, GBP, CAD, CHF, EUR, HKD JPY, SGD and USD.

Instruction submissions: For each custodian participating in CLSSettlement, DTCC submits netted cash flow amounts for the next value date to CLS in the relevant currencies.

Validation: CLS accepts and validates the cash flows and the accounts.

Settlement: The DTCC cash flows are then incorporated into the custodian’s CLSSettlement pay-in schedule and settlement cycle for the next day, along with their submitted FX payment instructions.

Notifications: Notifications are sent back to DTCC following settlement on value date.

Improves

- Post-trade processing

- Operational & funding efficiencies

Reduces

- Operational risk

6.5+ USD trillion

average settled each day

Awards

- Best Settlement Initiative 2023, FX Markets e-FX 2023

- Best FX Settlement & Risk Mitigation Solution, FX Markets Asia 2022 / 2021 / 2020

- Best Trading Infrastructure Provider, American Financial Technology 2021

Benefits:

- Fully automated processing to improve post-trade efficiency for derivatives instruments (CDS, CDX, CDT) and greatly reduce operational risk

- Optimize your operations – through straight-through processing and real-time information regarding settlement and confirmation

- Drive funding efficiency and lower your liquidity requirement through the use of multilateral netting

Settlement service model with DTCC

CLS Bank operational timeline – normal processing with Deriv/SERV

(Northern Hemisphere summer time)

| Settlement date -1 | Settlement date | ||||||

| Sydney | 04:00 | 08:00 | 14.30 | 16:00 | 17:00 | 18:00 | 20:00 |

| Tokyo | 03:00 | 07:00 | 13.30 | 14:00 | 16:00 | 17:00 | 29:00 |

| C.E.T | 20:00 | 00:00 | 16.30 | 07:00 | 08:00 | 09:00 | 11:00 |

| London | 19:00 | 23:00 | 05.30 | 06:00 | 08:00 | 09:00 | 11:00 |

| IPIS1 | RPIS2 | ST3 | SCTT4 | FCTT(AP)5 | FCTT(OC)6 | ||

| Real-time information available on status of payment instructions to members and Deriv/SERV | |||||||

1IPIS - Initial pay-in schedule issued

2RPIS - Revised pay-in schedule issued

3ST - Start of CLS Bank settlement

4SCTT - Settlement completion target time

5FCTT(AP) - Asia Pacific funding completion target time

6FCTT(OC) - Non-Asia Pacific funding completion target time

Next steps for asset managers

If you are considering how to better manage risk for your OTC derivatives cash flows:

- Contact your custodian(s) about the settlement solutions they offer for credit derivatives, including CLSSettlement

- Contact DTCC to request that central settlement is enabled for your account

- DTCC will provide you with the necessary documentation and forms to complete

- Send the form to your custodian to authorize

- Once complete send the form back to DTCC for final validation. DTCC then submits the form to CLS

- CLS will then take the necessary steps to permission your account.

For more information about the service and DTCC’s Trade Information Warehouse, please contact TIW@DTCC.com

FX Global code

Using CLS products and services plays an integral part in helping you comply with the FX Global Code.