Experience the collaboration

CLSMarketData | SIGTech

CLS and SIGTech have collaborated to provide a back testing environment and analytics platform to evaluate large-scale market data from CLS.

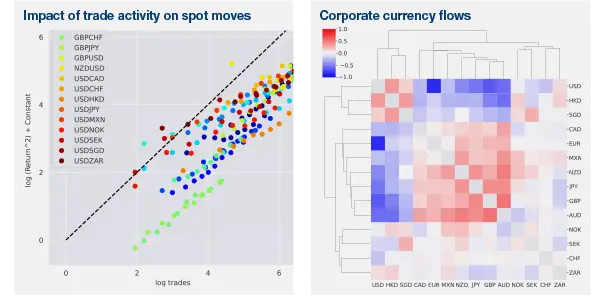

Combining the largest single source of FX alternative trade data with SIGTech’s expertise in multi-asset systematic investing, portfolio managers and quant researchers can find trading signals more effectively and derive greater value from our data.

Industry-leading backtesting environment

Finding signals from multiple data sets can be repetitive and labor intensive. With access to SIGTech’s industry-leading backtesting environment and analytics platform, you can reduce the time it takes to onboard, cleanse, validate and normalize data, while also reducing the cost of strategy development and deployment by up to 90 percent.

Evaluating large scale data requires significant resources and computing power. Access to SIGTech’s strong expertise and systematic analytics platform empowers portfolio managers and quant researchers by enabling them to focus on enhancing their strategies.