CLSNow

In the increasingly globalized financial markets, treasury departments within banks often have to source large amounts of currency on short notice.

With traditional sources of intraday liquidity, such as the contraction of the repo market, there is a growing need for a safe, intraday currency settlement service.

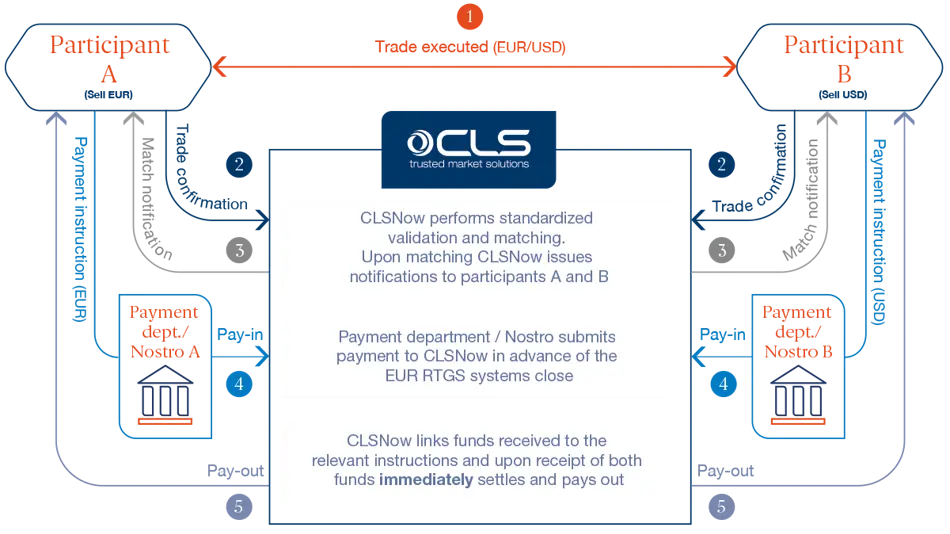

Bilateral same-day payment-v-payment (PvP)

CLSNow meets this need with bilateral same-day PvP gross settlement initially in CAD, EUR, GBP and USD. The service enables counterparties to optimize the use of available liquidity in the same-day market while mitigating settlement risk.

Improves

- Operational and funding efficiencies

- Access to liquidity

Reduces

- Settlement risk

- Credit risk

- Operational risk

- Liquidity risk

FX Global Code

Supporting adherence to the FX Global Code through:

Supporting adherence to the FX Global Code through:

- Principle 35, settlement risk

Mitigate the FX settlement risk associated with the out-legs of CLSSettlement in/out swaps and other same-day FX transactions using our gross payment-versus-payment settlement service.

Single trade settlement flow